sales tax oklahoma tulsa ok

The Oklahoma sales tax rate is currently. Owasso OK Sales Tax Rate.

The Tax Take From Medical Marijuana By County Oklahoma Watch

State of Oklahoma 45.

. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Other local-level tax rates. The average cumulative sales tax rate between all of them is 828.

As far as all cities towns and locations go the place with. The average cumulative sales tax rate in Tulsa Oklahoma is 831. Mingo Road Tulsa OK 74116 800 793-2929 - toll free 918 234-8900 - phone Directions Hours Watch This 1805 Watching Contact Us General Manager Lola Aranda Trust Palm Harbor.

The total tax rate might be as high as 115 percent depending on local municipalities. Norman OK Sales Tax Rate. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The most populous location in Tulsa County Oklahoma is Tulsa. City of Tulsa Sales Tax Code.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The current state sales tax rate in Oklahoma OK is 45 percent. Some local sales taxes are for general purposes and some are dedicated or.

Tulsa has parts of it located within Creek. Some cities and local governments in Tulsa County. Nearby homes similar to 3012 N Tulsa Dr have recently sold between 81K to 549K at an average of 145 per square foot.

This includes the rates on the state county city and special levels. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. With over 20 years of accounting and bookkeeping experience AQ Financial handles your books and taxes so you dont have to.

Title 43C 1991 Sales Tax. Tulsa OK Sales Tax Rate. This is the total of state county and city sales tax rates.

Title 43B 1985 Sales Tax Expenditure Policy. 4409 NW 56th St Oklahoma City OK 73112. Some cities and local.

Ponca City OK Sales Tax Rate. SOLD JUN 6 2022. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. City of Duncan Oklahoma Home. The current total local sales tax rate in Tulsa OK is 8517.

The Tulsa County Sales Tax is 0367. The 2018 United States Supreme Court decision in South Dakota v. Oklahoma City OK Sales Tax Rate.

Nearby Recently Sold Homes. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent. Nearby homes similar to 5907 N Tulsa Ave have recently sold between 190K to 410K at an average of 145 per square foot.

The Oklahoma state sales tax rate is currently 45. Sales tax exemptions apply to Interstate 1-800 WATS and interstate private-line business telecommunication services and to cell phones sold to a vendor who transfers the equipment. SOLD APR 21 2022.

Nearby Recently Sold Homes. 220000 Last Sold Price. SOLD MAY 20 2022.

Sales Tax in Tulsa. The Tulsa County sales tax rate is 037. Nearby homes similar to 5202 N Tulsa Ave have recently sold between 147K to 290K at an average of 140 per square foot.

The December 2020 total local sales tax rate was also 8517. 195000 Last Sold Price. 5921 E Admiral Pl.

There is no applicable. The Tulsa Oklahoma sales tax is 450 the. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Title 43A 1980 Sales Tax Expenditure Policy. There is no applicable special tax. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

Tulsa Ok Farms Ranches For Sale Realtor Com

Tulsa Market Brief Research Wizard

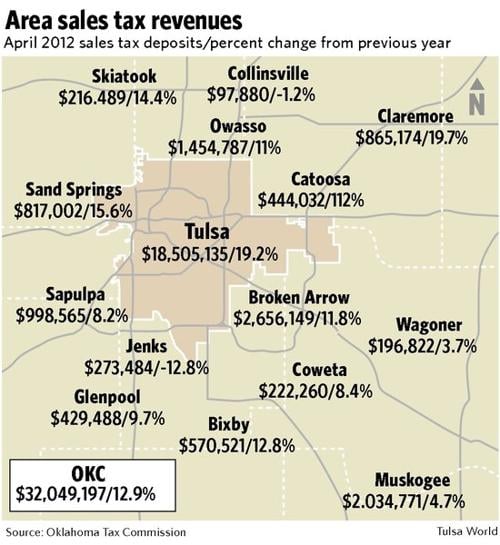

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

State And Local Tax Distribution Oklahoma Policy Institute

Oklahoma Tax Free Weekend Returns Friday News Normantranscript Com

Promised Land Oklahoma Has Few Restrictions On Religious Property Tax Exemptions

Tulsa Ok Real Estate Tulsa Ok Homes For Sale Zillow

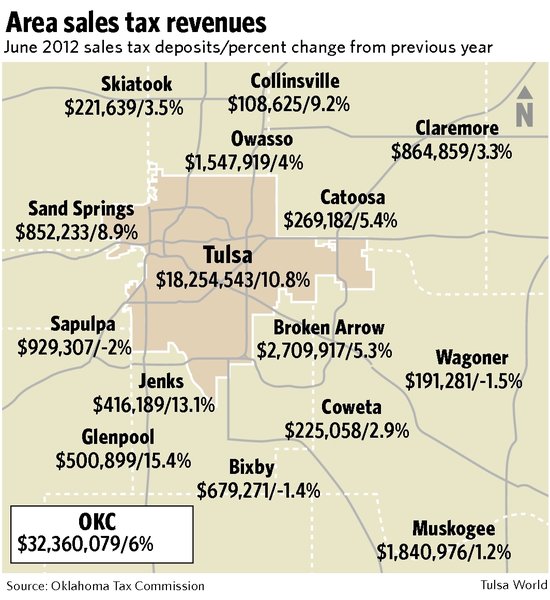

Sales Tax Revenue For City Up 10 8 Percent Over Last June Politics Tulsaworld Com

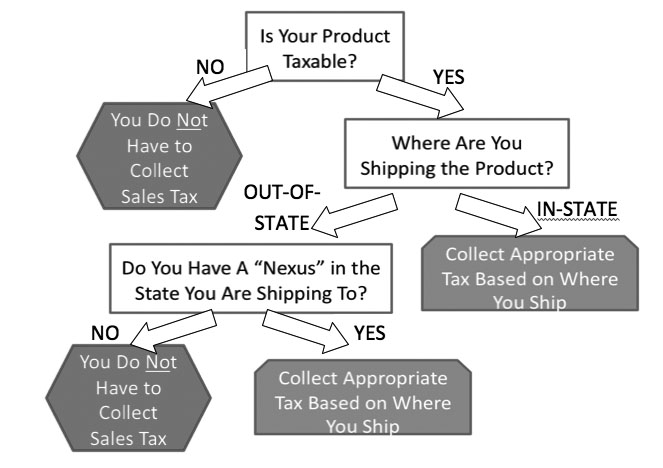

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

Oklahoma Income Tax Calculator Smartasset

Should Oklahoma Broaden The Sales Tax To More Services Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Vision2025 Economic Development And Capital Improvement For Tulsa County

How Oklahoma Taxes Compare Oklahoma Policy Institute

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

Preparing For The Tax Deed Sale Avoiding Risks Tulsa Ok Auction Review Youtube